Duration: 4 weeks

Tools: Lucid Chart, Zoom

Skills: Data Analysis, User Research

Role: User Researcher

Team: 4 students

Problem Statement

Self-employment poses many unique challenges, including unpredictable income, stressful work-life balance, and lack of benefits and financial literacy guidance, all of which may lead to long-term financial insecurity.

How might we develop effective mental health support systems to address the financial instability faced by self-employed individuals? By interviewing key stakeholders—self employed workers and mental health professionals—we aimed to gain insights about the pain points, goals, and perspectives regarding self employment and financial insecurity.

The Background 👷

Ann Arbor SPARK is a nonprofit organization dedicated to developing and supporting entrepreneurs, small businesses, and startups in the southeast Michigan area, with the goal to economically develop Ann Arbor as a growing technology and innovation hub.

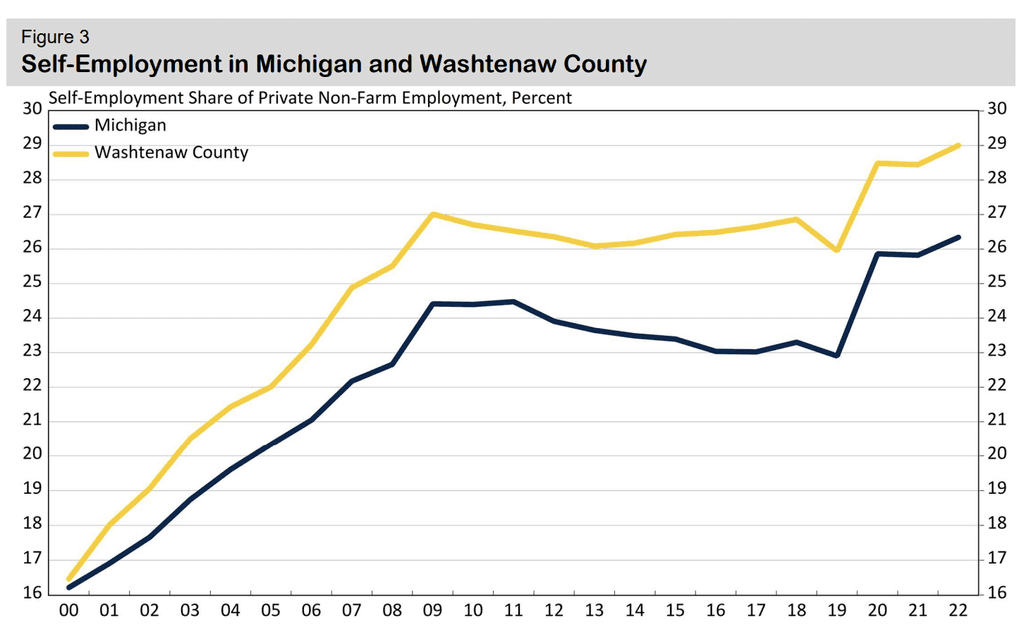

Direct rise of self-employment in Ann Arbor from 2020

What does this mean for Ann Arbor SPARK and the self-employed individuals rising by the numbers?

Self-employed work can cause mental health challenges and financial insecurity among individuals.

How can this be prevented within Ann Arbor, considering the sudden rise of self-employment?

Our Project 🧠

Data Collection + Analysis 📈

We conducted 10 user interviews with different stakeholders:

self-employed

indivuduals

small business

owners

mental health

professionals

Mental health professionals + self employed workers (n=10)

~30-40 min interviews conducted via Zoom

Gather pain points, goals, & perspectives of the self-employment environment

Academic Journals:

Desktop/background research on correlations between mental health and employment type

Studies on financial insecurity and mental health

Media Articles

Current media publications and forums

Gain insight about current landscape and community opinions

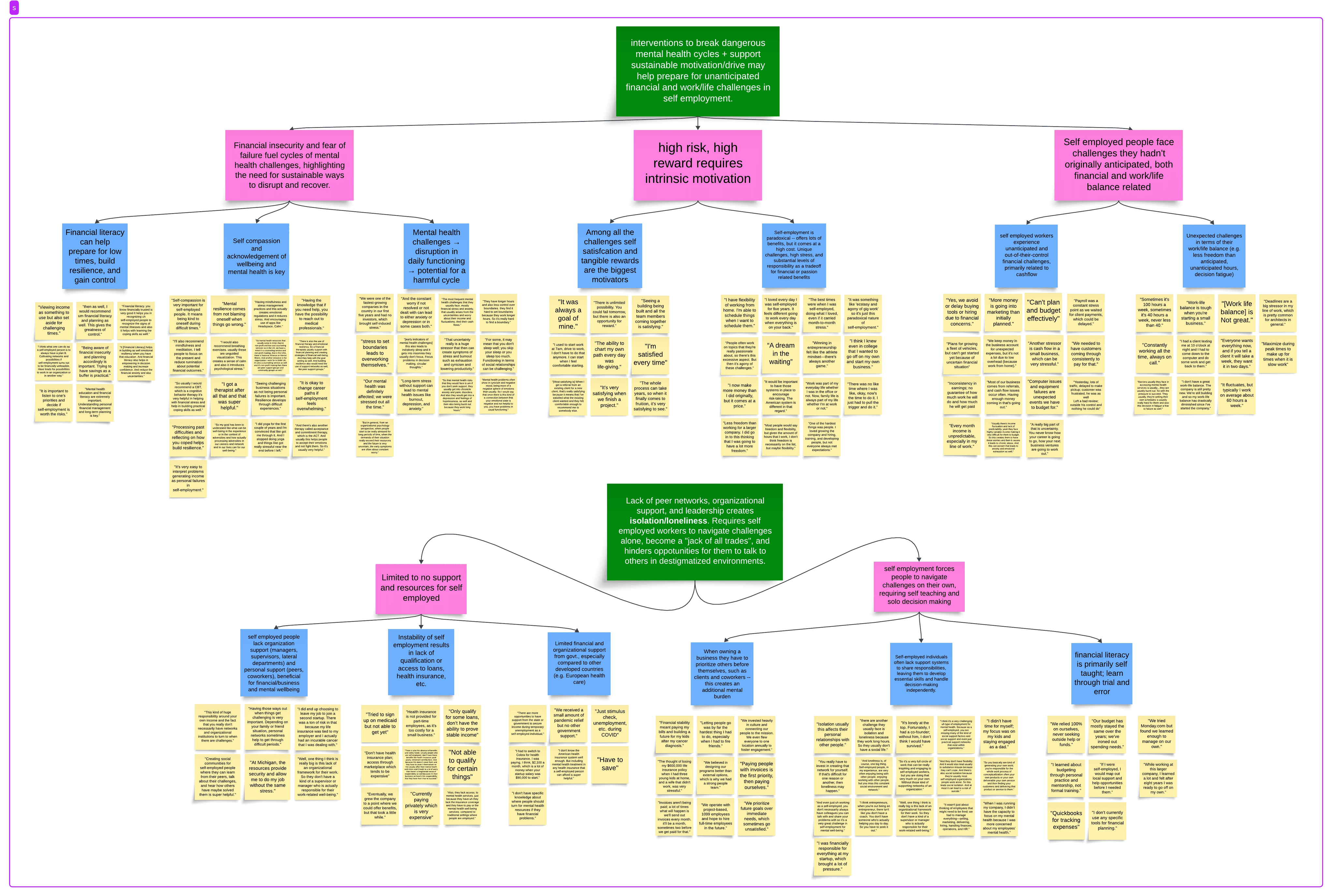

We conducted affinity diagramming to thematically analyze and contextualize the problem space and iterate on design solutions.

Key Findings 🔎

Self employed workers need to be a “jack of all trades”

Expected to learn and master a wide range of skills

Creates burden to support themselves, the business, clients, and others

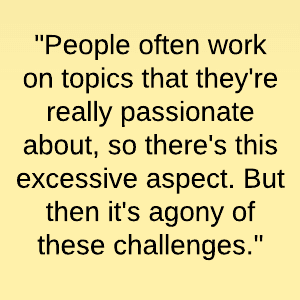

Paradoxical nature of self employment (high risk, high reward)

Expected to learn and master a wide range of skills

Creates burden to support themselves, the business, clients, and others

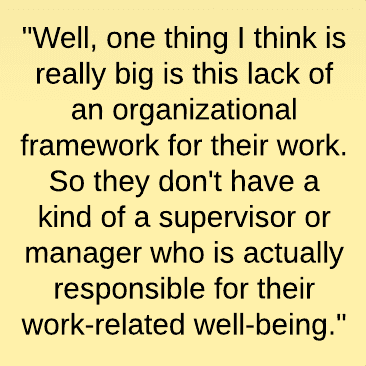

Limited mental health resources and destigmatized community and organization support

Little opportunity to share their struggles and show vulnerability

Key Solutions/Recommendations 💡

Peer Support Groups

Create safe and non-judgmental spaces for entrepreneurs to de-stigmatize mental health check-ins. Groups could be based on similar traits/industry, to build trust and share strategies for navigating challenges.

Custom-tailored events

Host interactive webinars, workshops, discussion panels, etc. or enhance Boot camps focusing on burnout prevention, work-life balance, and financial resilience. Offer incentives for attendance such as discounted workspaces to increase accessibility to the programs.

Business Consulting Support

Provide comprehensive financial counseling with financial advisors/freelancer matching focused on delivering financial strategies and trainings on utilizing financial tools. Help entrepreneurs effectively manage finances, reduce stress, and focus on growing their businesses.

Final Presentation!

My group was selected to present by our professor in front of 200+ people including C-Suite executives!